This case study article details how we managed to create end-to-end and sophisticated churn management solutions for several companies acting in the Wealth Management industry.

Key Challenges

Banking relationships in wealth management are relationships of trust to a special degree, if only because of the exceptionally high level of customer assets (Very/Ultra High Net Worth Individuals: VHNWI or UHNWI) and the thematic range of advice.

The central challenge for a leading wealth management group was therefore to create and productively use an early warning system that shows the evolution of customer relationships over time. On this basis, it is possible to forecast when the overall strength of a customer relationship – and thus customer satisfaction and loyalty – will decline to such an extent that an appropriate action by the relationship manager is recommended.

Our Approach

- “Customer Analytics” Status quo analysis as a prerequisite for the project success

- Measurement & prediction of the strength of the customer relationship (customer-specific)

- Agile development of the churn early warning system in an in-house AI innovation lab in cross-functional teams under startup conditions

- Start of regular production operation of the churn early warning system as well as integration into the global Management Information System (MIS)

- Extensive training & coaching of relationship managers in several countries in the interpretation and use of the analysis results

Benefits

- In-depth understanding of the risk factors of a customer relationship and their individual characteristics through the use of an explanatory component in the presentation of forecasts

- High acceptance by the main users (relationship managers, sales managers) through an integrated feedback component in the early churn warning system

- Separate, fully digitalized feedback process for each action recommendation issued enables continuous improvement of forecast quality

- Roll-out & live operation of the system to additional sites and countries

Expert Insight

Most projects in the churn management in wealth management remain stuck in pilot status, where a high quality of churn prediction is already celebrated as a project success. In this industry in particular, however, the central customer contact takes place via the numerous relationship managers. Thus, for a measurable end-to-end project success, it is essential to focus on the productive implementation of the results already at the beginning of the project.

Peter Neckel, Head of Customer Analytics at Positive Thinking Company

Team Involved on this Project

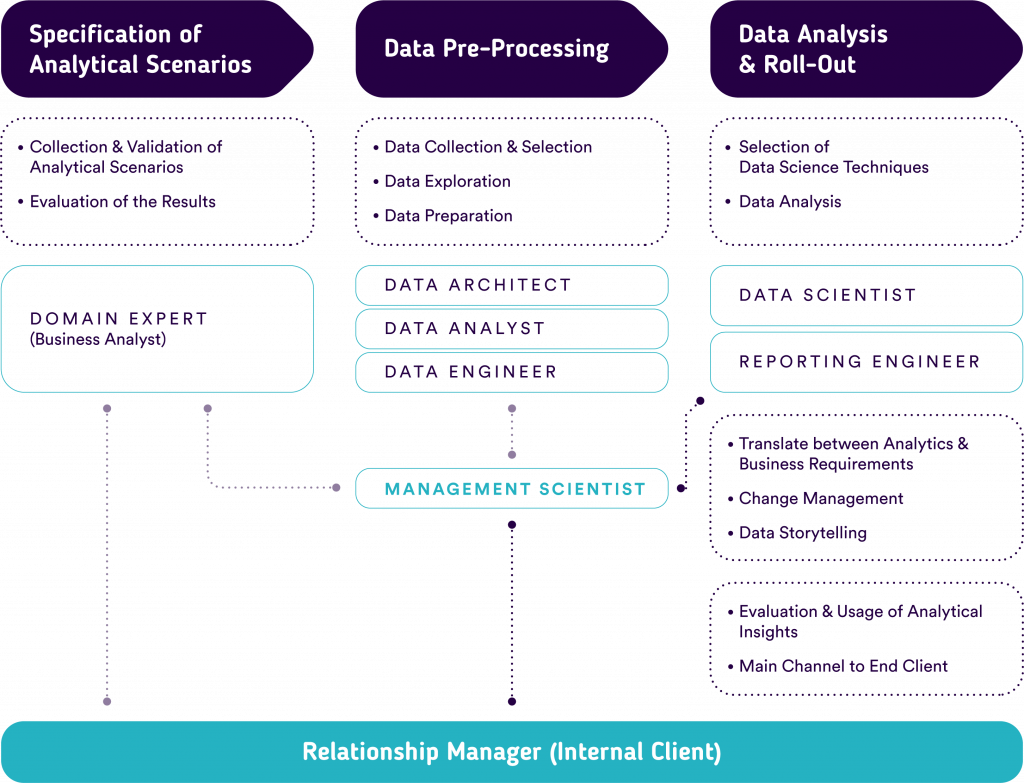

An important step towards the success of Data Science projects in general is therefore the decision for a suitable, easily expandable team structure with clear roles and responsibilities (see below).

One of the most important roles for success is the Management Scientist (see figure above, highlighted in dark green) as a central mediator, especially between the relationship managers and the Data Scientists. The Management Scientist assumes a translation and coaching function by mediating between the different language and topic worlds: Technical requirements and restrictions on the side of the Data Scientists in contrast to business (customer) needs of the relationship managers.

Depending on the individual situation, central change management tasks remain at the heart of a Management Scientist, which sometimes require high communication skills – for example, in the question of the extent to which insights from churn analytics can complement the personal attitude and years of customer knowledge of a relationship manager. This is where the foundation is laid for the subsequent acceptance of the solution overall.