In the complex realm of asset management, understanding the Environmental, Social, and Governance (ESG) practices of global enterprises is a monumental task. A leading Asset Manager in Germany had to analyze the vast and varied ESG reports of over 7,000 large enterprises. This is where the transformative capabilities of Natural Language Processing (NLP) came into play. Discover how we’ve combined advanced technology with industry expertise, offering a fresh lens to interpret and analyze global ESG data.

Context & Challenges

Our client, a distinguished Asset Manager, performs meticulous analysis of organizations’ ESG aspects. Their expertise spans across a vast spectrum, scrutinizing over 7,000 large enterprises to discern their influence on pivotal topics ranging from Biodiversity and Circular Economy to Climate Change and Human Rights.

For our client, the realm of ESG analysis is not just about assessing companies’ sustainability practices; it’s also about ensuring that their asset management services align with the evolving regulatory landscape. Public funds under their management are bound by the stringent ESG reporting requirements set by regulatory authorities like ESMA and BaFin. These mandates necessitate transparency, accuracy, and timeliness in reporting. Concurrently, their private investors, driven by a deep-seated commitment to ethical investment, seek assurance that their capital is channeled in alignment with specific ESG guidelines.

However, the journey to achieving comprehensive and compliant ESG reporting is riddled with challenges. The ESG analysts at our client’s firm are faced with a large volume of data, sourced from over 12,000 distinct ESG metrics. These metrics, provided by a burgeoning number of ESG data vendors, come in varied formats and intervals, adding layers of complexity to the data assimilation process. The sheer diversity and volume of this data underlines the need for a system that can seamlessly integrate and interpret this information, ensuring that the insights derived are both meaningful and actionable.

Yet, the challenges don’t end there. In their pursuit of comprehensive ESG analysis, the analysts often encounter data voids—situations where critical ESG data is either missing or unavailable. These gaps in information not only hinder the analysis but also pose a risk of non-compliance. Therefore, our client needed to find innovative solutions that can aid in data collection, and more importantly, support the analysts in their quest for data search, analysis, and extraction.

In essence, our client stood at a crossroads, seeking a path that would allow them to harmonize their vast and diverse ESG data sources while ensuring they remain compliant with regulatory mandates. They needed a solution that was not just technologically advanced but also intuitive, ensuring that the unique challenges they faced were addressed holistically.

Our Approach

Navigating the intricate maze of ESG reporting and data requires more than just expertise—it demands innovation. In our journey with our client, we combined cutting-edge NLP techniques with a deep understanding of the ESG landscape.

Assessment of the Current ESG Landscape

In our initial phase, we embarked on a comprehensive assessment of the existing ESG data landscape. This involved a deep dive into the tools, workflows, and methodologies currently employed by our client. By understanding the status quo, we could pinpoint areas of improvement and identify opportunities for innovation.

Extending ESG Data Capabilities with NLP

Recognizing the potential of NLP in addressing the challenges faced by our client, we explored avenues to extend available ESG data using NLP techniques. This not only involved harnessing existing data more effectively but also leveraging NLP to automate processes and to fill the gaps where data was missing or sparse.

Collaborative Development of Prototypes

In collaboration with our client, we initiated the development of prototypes, including Proof of Concepts (PoCs) and Minimum Viable Products (MVPs). These prototypes served as tangible representations of our proposed NLP solutions, allowing us to test, iterate, and refine our approach in real-world scenarios.

Focusing on High-Impact Solutions

Among the myriad of possibilities, we zeroed in on the most promising NLP solutions:

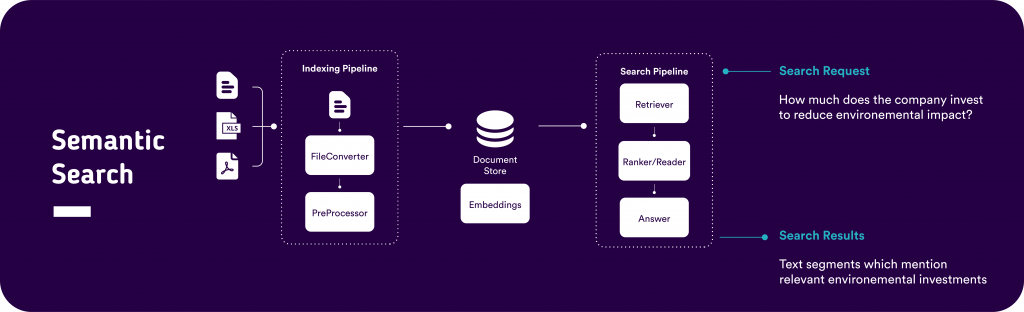

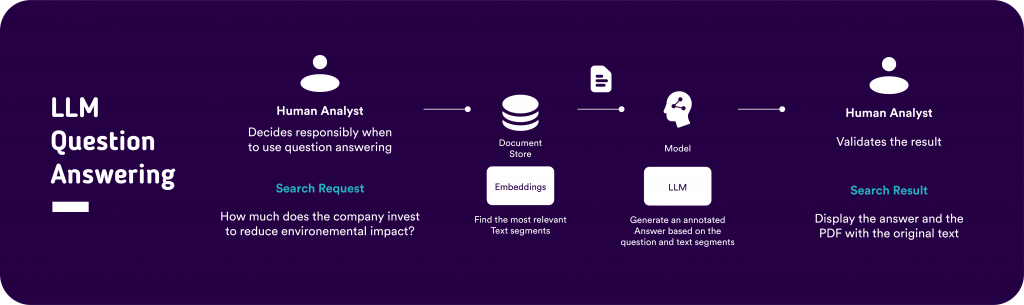

- Semantic Search: By understanding the context and meaning behind the search query, this function allows for efficient and accurate identification of relevant information. It was used to search the 12,000 metrics or large text documents and PDFs. This way, we empowered analysts to swiftly locate specific ESG metrics among vast data volumes, streamlining the research process.

- ESG Report Scraping and Data Extraction: By scraping a significant 8.5 GB of company Sustainability Reports from 2022, we could augment the available data, ensuring a richer and more comprehensive dataset for analysis.

- Early Detection of Norm Violations: Using advanced NLP techniques, we developed systems to detect potential norm violations in news articles and financial documents, providing analysts with timely alerts and insights.

Utilizing State-of-the-Art NLP Models

Our approach was relying on the usage of cutting-edge NLP models, including BERT, Sentence-Transformer, and Large Language Models (LLMs). These models were tailored to the unique requirements of ESG reporting, ensuring precision and accuracy in data search, question answering, and ESG text classification.

Seamless Integration into Existing Workflows

Understanding the importance of a smooth transition to ensure change management and adoption, we prioritized the early integration of our NLP solutions into the client’s existing workflows. This ensured that the benefits of our approach could be realized immediately, while also allowing for iterative feedback and adaptation of functionality based on real-world usage.

Key Benefits

Taking Research Methodologies to a New Level

Our introduction of new research methodologies, powered by NLP, transformed the way ESG analysts approached their tasks. With tools that could swiftly locate, analyze, and extract relevant data, analysts can now delve deeper into their research, uncovering insights that were previously elusive.

Adaptable Data Infrastructure

In the ever-evolving world of ESG reporting, adaptability is key. We provided our client with a flexible data infrastructure, meticulously designed to handle expansion and change. This ensured that as the ESG landscape evolved, our client’s systems can adapt seamlessly, staying ahead of the curve.

A Strong Foundation for Future Innovations

Our solution lays a solid foundation for the continued utilization of NLP and ML models. With the groundwork in place, our client is poised to harness future advancements in technology, ensuring that their ESG reporting analysis remains at the forefront of innovation.

Enriched Data for Deeper Insights

By researching publicly available data for specific requests, we enriched the client’s data pool. This allows analysts to gain a more comprehensive external perspective on companies, identifying potential pitfalls and opportunities that would otherwise go unnoticed.

Unlocking New Use Cases

With consolidated data and advanced NLP models at their disposal, our client discovered room for new use cases. The potential applications of the data and models extend beyond just ESG reporting analysis, opening doors to brand-new advanced analytics capabilities.

Elevating our Client Advisory Services

One of the most profound benefits is the transformation in how our client advises their own customers. The labor-intensive process of identifying data and insights in reports is now significantly automated. This shift allows the workforce to redirect their focus towards more value-added activities, enhancing the overall quality and depth of their advisory services.

In essence, our NLP-driven approach didn’t just address the immediate challenges faced by our client – it set them on a trajectory of sustained growth, innovation, and excellence.

Team Involved in this NLP Project for ESG Insights

In any groundbreaking project, the technology and strategies employed are only as effective as the team implementing them. We allocated a dedicated and skilled team ensuring the seamless integration of our NLP-based approach.

- Data Scientist: At the core of our team was our Data Scientist, who played a pivotal role in crafting and refining the NLP models. With a deep understanding of both the ESG landscape and advanced ML techniques, they ensured that our solutions were tailored to the unique challenges and requirements of the project.

- Data Engineer: Complementing the expertise of our Data Scientist was our Data Engineer. Their role was instrumental in building the robust and flexible data infrastructure that underpinned our solutions. From data ingestion and preprocessing to integration with existing systems, the Data Engineer ensured that data flowed seamlessly, was accessible, and ready for analysis.

The collaboration between the Data Scientist and Data Engineer spanned 16 months, during which they worked in tandem to transform the ESG reporting analysis process for our client. Their combined expertise, dedication, and innovative spirit were the driving forces behind the project’s success.

Technologies Used in this NLP project for ESG Insights

In order to achieve these project goals, a suite of cutting-edge technologies was used. These tools and frameworks were chosen for their robustness, scalability, and adaptability, ensuring that our solution was both efficient and future-proof.

- Python: Serving as the backbone of our data processing and NLP tasks, Python’s versatility and rich ecosystem made it the ideal choice. Its extensive libraries and frameworks facilitated everything from data manipulation to advanced ML operations.

- Hugging Face: An open source platform for developing, training and sharing NLP models, Hugging Face provided us with pre-trained models which enable faster and more accurate NLP solutions, saving time and resources required for training from scratch.

- PyTorch: As one of the leading deep learning frameworks, PyTorch offered the flexibility and power needed for our NLP models. Its dynamic computation graph and extensive library ensured efficient model optimization, allowing us to tailor models to the specific needs of ESG reporting analysis.

- Qlik: To present and share our findings and insights in an intuitive and interactive manner, we utilized Qlik. This data visualization and business intelligence tool enabled us to craft dashboards and reports that brought our data to life, providing analysts with actionable insights at their fingertips.

- aiohttp: Handling vast amounts of data requires efficient and scalable data retrieval methods. With aiohttp, an asynchronous HTTP client/server framework, we ensured swift and seamless data fetching, making the data ingestion process smooth and efficient.